APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

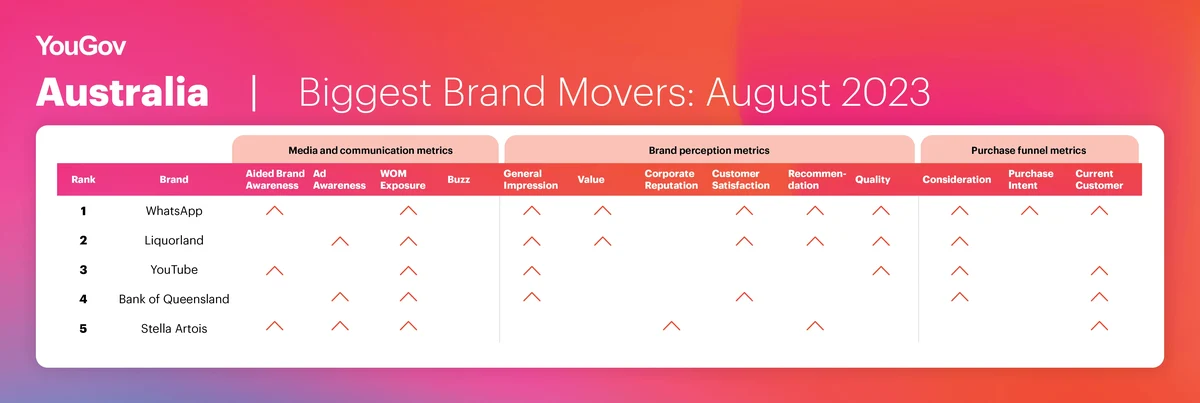

Australia: WhatsApp leads with new screen-sharing feature

WhatsApp is Australia’s Biggest Brand Mover for August.

The Meta-owned messaging app made gains in 10 out of 13 YouGov BrandIndex metrics, in the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Value, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

In early August, Meta founder and CEO announced that WhatsApp is adding a screen-sharing feature during video calls, though it's unclear when the feature will be widely available for all users.

Liquorland is the runner-up, with the alcoholic beverage retailer scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. YouTube takes third place, with the video sharing platform seeing improvements in six metrics across all three categories.

Bank of Queensland and beer brand Stella Artois round out the top five, making gains in six metrics each.

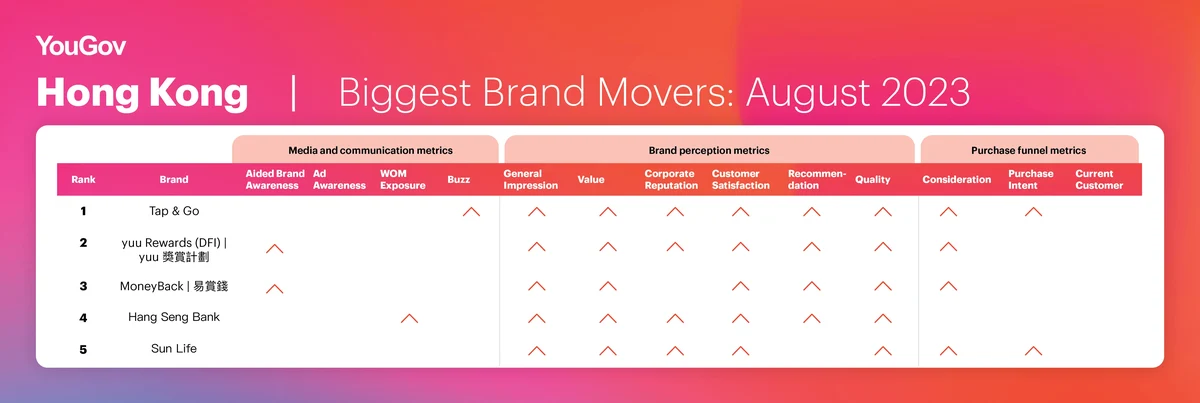

Hong Kong: Tap & Go scores with e-commerce promotions

Tap & Go is Hong Kong’s Biggest Brand Mover for August.

The mobile wallet made gains in nine out of 13 YouGov BrandIndex metrics, in the Media and Communication category (Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent).

Tap & Go recently ran a series of e-commerce promotions for its users. This included a HK$20 discount on purchases from the iGameBUY website (with a minimum spend of HK$600) for shoppers who use Tap & Go as their payment option, as well as up to 5% spending rebates for members of Hong Kong Telecom (HKT) Group’s customer loyalty program – The Club – when they complete purchases on The Club website or mobile app using the Tap & Go App.

yuu is the runner-up, with the DFI Retail Group’s customer rewards app scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Moneyback takes third place, with the Watson Group’s customer rewards program seeing improvements in seven metrics across the Media and Communication category.

Hang Seng Bank and Sun Life insurance round out the top five, making gains in seven metrics each.

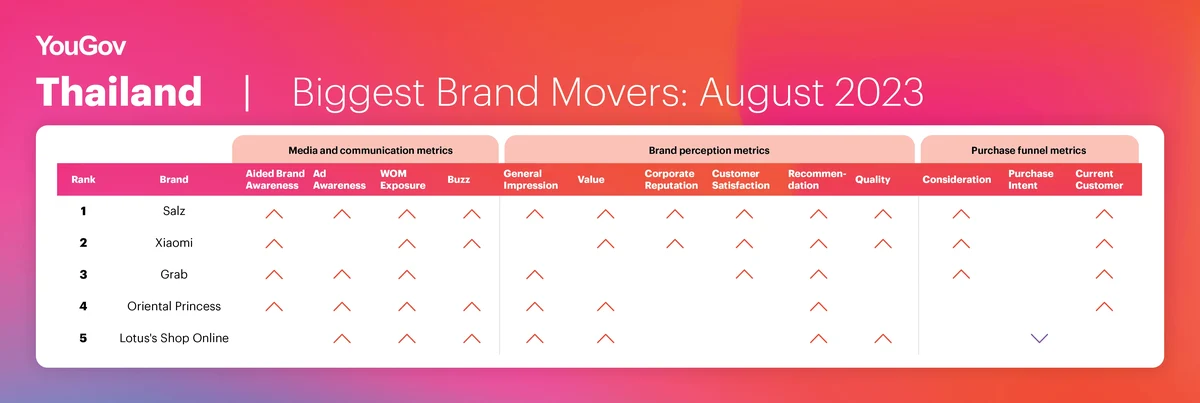

Thailand: Salz lands top spot with K-drama feature

Salz is Thailand’s Biggest Brand Mover for August.

The Lion-owned brand made gains in twelve out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Customer Satisfaction, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

Salz’s King Herb toothpaste was recently featured in popular K-drama King the Land, where its main character – King Hotel’s General Manager Gu Won (played by Lee Jun-ho) – is seen purchasing large quantities of the oral care product for his friends. Social media users subsequently posted about this on Facebook and X (formerly Twitter).

Xiaomi is the runner-up, with the consumer electronics and smartphone manufacturer scoring upticks in ten metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Grab takes third place, with the ride-hailing platform seeing improvements in eight metrics across all three categories.

Beauty and personal care brand Oriental Princess and general retailer Lotus’s Shop Online round out the top five, making gains in eight and seven metrics respectively.

Was your brand one of APAC’s Biggest Movers in August?

Uncover the other brands that were among the top ten in Australia, Hong Kong and Thailand

by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for August 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Indonesia, Japan, Malaysia, Singapore, Philippines, and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for August 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between July and August 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time