APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

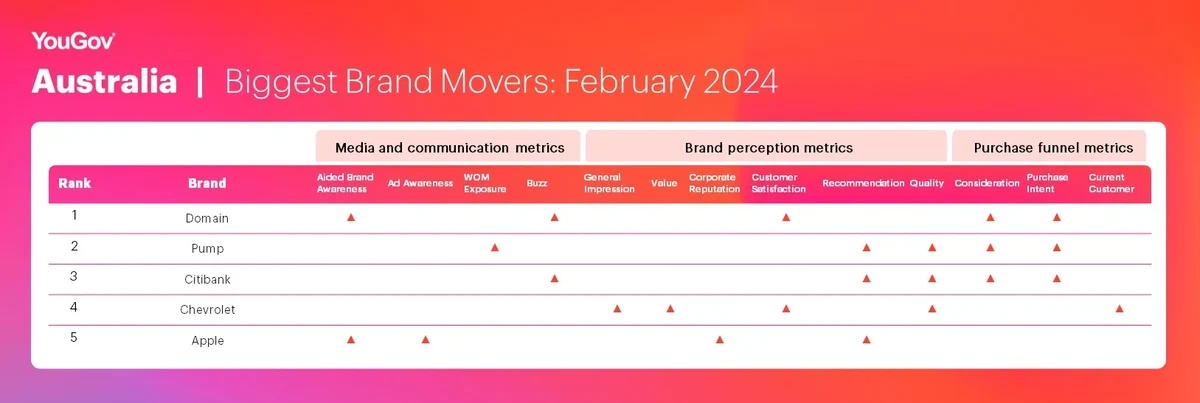

Australia: Domain powers ahead with new property valuation model

Domain is Australia’s Biggest Brand Mover for February.

The online real-estate portal made gains in five out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Buzz), Brand Perception category (Customer Satisfaction) and Purchase Funnel category (Consideration, Purchase Intent).

Domain recently announced that it has enhanced the accuracy of property price estimates listed in Pricefinder – the company’s property intelligence platform on more than 13 million Australian residences, collated over 30 years of sales histories and auction results – with the successful integration of its automated valuation model (AVM) into the Pricefinder desktop and mobile apps.

Pump is the runner-up, with the Coca-Cola owned beverage brand scoring upticks in five metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Citibank takes third place, with the multinational financial institution also seeing improvements in five metrics across all three categories.

Automaker Chevrolet and tech giant Apple round out the top five, making gains in five and four metrics respectively.

Hong Kong: Cathay Pacific flies high with Samsung Galaxy S24 co-branded campaign

Cathay Pacific is Hong Kong’s Biggest Brand Mover for February.

The delivery and logistics company made gains in six out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness), Brand Perception category (General Impression, Customer Satisfaction, Quality) and Purchase Funnel category (Consideration, Current Customer).

Cathay Pacific recently launched a co-branded campaign with Samsung Hong Kong promoting the Galaxy S24 series’ AI-powered live translation and interpretation capabilities for users looking for an ideal travel phone on their next overseas trip with Cathay Pacific.

Now is the runner-up, with the pay TV service provider scoring upticks in five metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. HSBC takes third place, with the multinational financial institution seeing improvements in four metrics across the Media and Communication as well as Purchase Funnel categories.

Insurance provider Manulife and mobile payment service PayMe round out the top five, making gains in four metrics each.

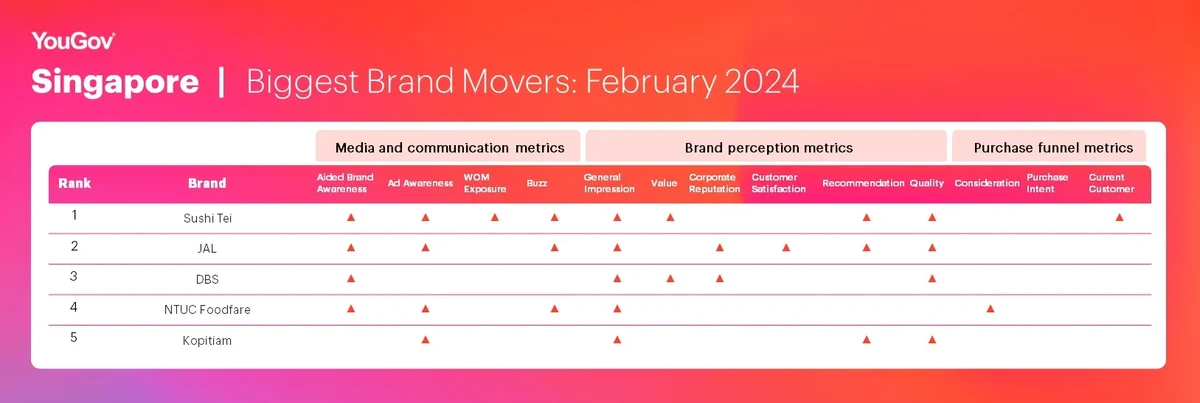

Singapore: Sushi Tei wins with 1-for-1 deals

Sushi Tei is Singapore’s Biggest Brand Mover for February.

The Japanese restaurant chain made gains in nine out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Recommendation, Quality) and Purchase Funnel category (Current Customer).

Sushi Tei recently tied up with UOB cards to offer a 1-for-1 deal on the restaurant’s tuna sushi and beer cocktails for customers who dine-in at any of its outlets.

Japan’s flag carrier JAL is the runner-up, with airlines scoring upticks in eight metrics across the Media and Communication and Brand Perception categories. DBS takes third place, with the payments service provider seeing improvements in five metrics across the two categories as well.

Food caterer NTUC Foodfare and food court operator Kopitiam round out the top five, making gains in five and four metrics respectively.

Was your brand one of APAC’s Biggest Movers in February?

Uncover the other brands that were among the top ten in Australia, Hong Kong, Indonesia and Singapore by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for February 2024 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Japan, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for February 2024 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between January and February 2024.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time