APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

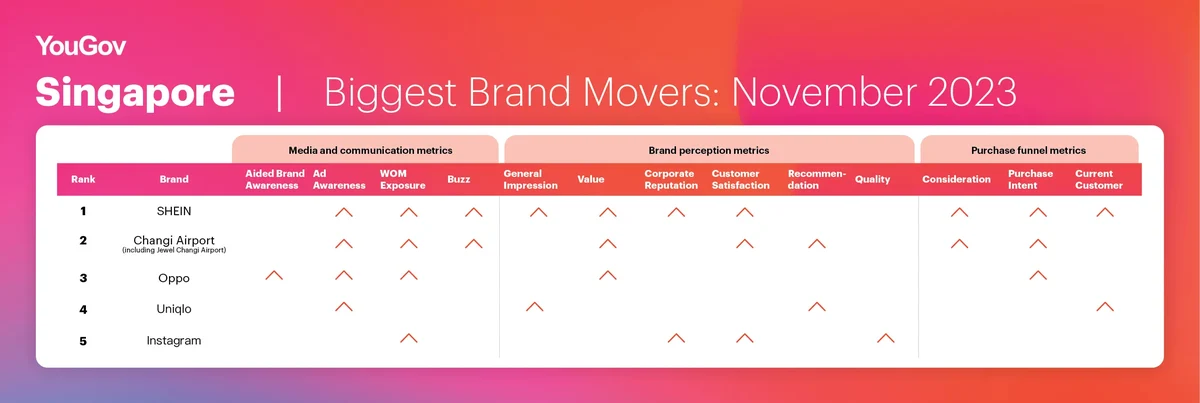

Singapore: SHEIN scores with Singles Day deals and sustainability push

SHEIN is Singapore’s Biggest Brand Mover for November.

The e-commerce platform made gains in 10 out of 13 BrandIndex metrics, in the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

The fast fashion retailer ran a wide range of promotions around 11.11 Singles Day, including cashback deals for customers who make purchases using OCBC, UOB and Citibank credit cards, as well as gift card giveaways for customers who like their associated social media posts and tag their friends.

Separately, in late November, SHEIN’s global head of sustainability also appeared on news channel CNA’s podcast, where he sought to debunk allegations that SHEIN underpaid its garment production workers and was environmentally unsustainable, instead attributing its low product prices due to an on-demand business model that reduces waste.

Changi Airport and Jewel mall is the runner-up, scoring upticks in eight metrics across the Media and Communication, Brand Perception categories and Purchase Funnel categories. Oppo takes third place, with the smartphone maker seeing improvements in five metrics across all three categories as well.

Fast fashion retailer Uniqlo and social media platform Instagram round out the top five, making gains in four metrics each.

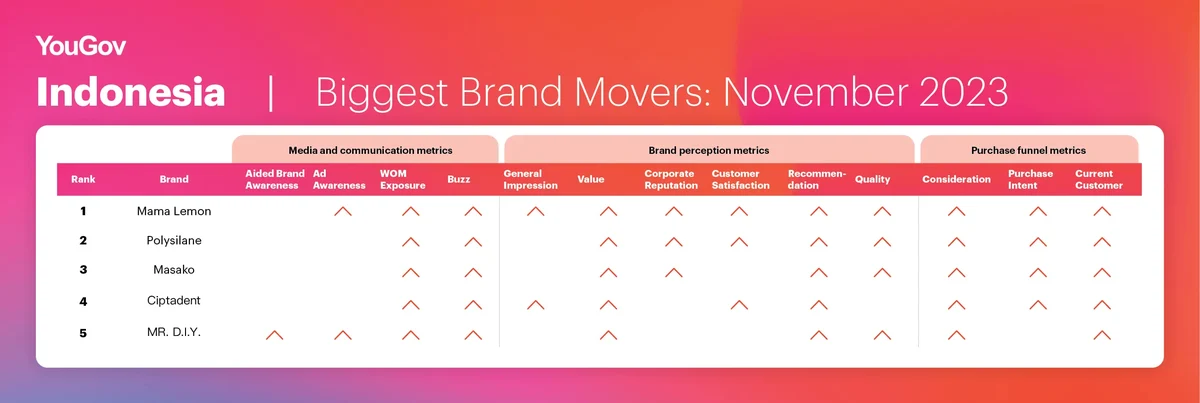

Indonesia: Mama Lemon top of table amidst price offers and Gaza conflict

Mama Lemon is Indonesia’s Biggest Brand Mover for November.

The Lion Corporation brand made gains in 12 out of 13 BrandIndex metrics, in the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

Retail chain Alfamart recently launched a promotion for its dishwashing products. Additionally, in light of the ongoing military conflict in Gaza, which has led to a consumer boycott in Indonesia of goods from companies seen to be supporting Israel, Mama Lemon was highlighted in a number of online publications (serayunews, kaltimtoday, hops.id) as a recommended dishwashing soap brand for shoppers who want to avoid “pro-Israel” products.

Mama Lemon was also one of Indonesia’s most talked about brands in November.

Polysilane is the runner-up, with the Pharos-owned gastritis medicine brand scoring upticks in 10 metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Masako takes third place, with the Ajinomoto-owned seasoning brand seeing improvements in nine metrics across all three categories.

Oral care brand Ciptadent and hardware store Mr D.I.Y. round out the top five, making gains in nine metrics each.

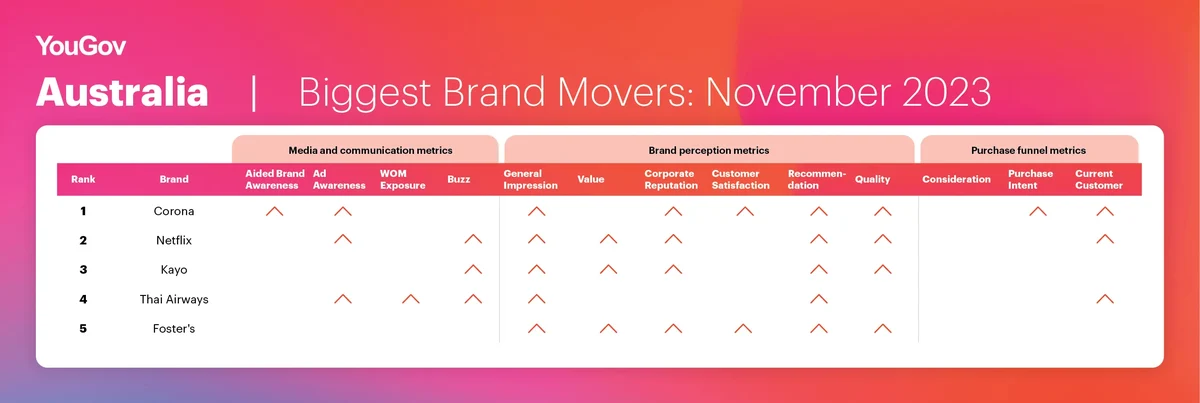

Australia: Corona leads summer beer season

Corona beer is Australia’s Biggest Brand Mover for November.

The AB InBev brand made gains in nine out of 13 BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, Ad Awareness), Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Purchase Intent, Current Customer).

As summer rolls around in Australia, beer consumption is expected to increase. Corona beers are available across major liquor stores such as BWS and Dan Murphy’s.

Netflix is the runner-up, with the OTT video streaming platform scoring upticks in eight metrics across the Media and Communication, Brand Perception categories and Purchase Funnel categories. Kayo takes third place, with the live sports OTT streaming provider seeing improvements in six metrics across the Media and Communication plus Brand Perception categories.

Thai Airways and lager brand Foster’s round out the top five, making gains in six metrics each.

Was your brand one of APAC’s Biggest Movers in November?

Uncover the other brands that were among the top ten in Australia, Singapore and Indonesia by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for November 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Hong Kong, Japan, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for November 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between October and November 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time