- Three-quarters (73%) Australians have bought shopped online in the past three months compared to four in five (89%) who shopped in-store

- Clothing and footwear are the items people most prefer to purchase in-store

- Three in ten (29%) say adhering to social distancing measures is a barrier to shopping at brick & mortar stores

- The main motivation for online shopping is doorstep home delivery

COVID-19 has had a profound impact on shopping attitudes and behaviours globally. While shopping has shifted online during the pandemic, consumer preference for brick-and-mortar remains high. YouGov’s latest whitepaper ‘International Omni-Channel Retail Report 2021: Shopping in the pandemic and the implications for the future’ looks at shopping behaviours amongst Australians to understand the cross-channel interplay between online and brick-and-mortar outlets, as well as motivations and barriers between these two types of retailers.

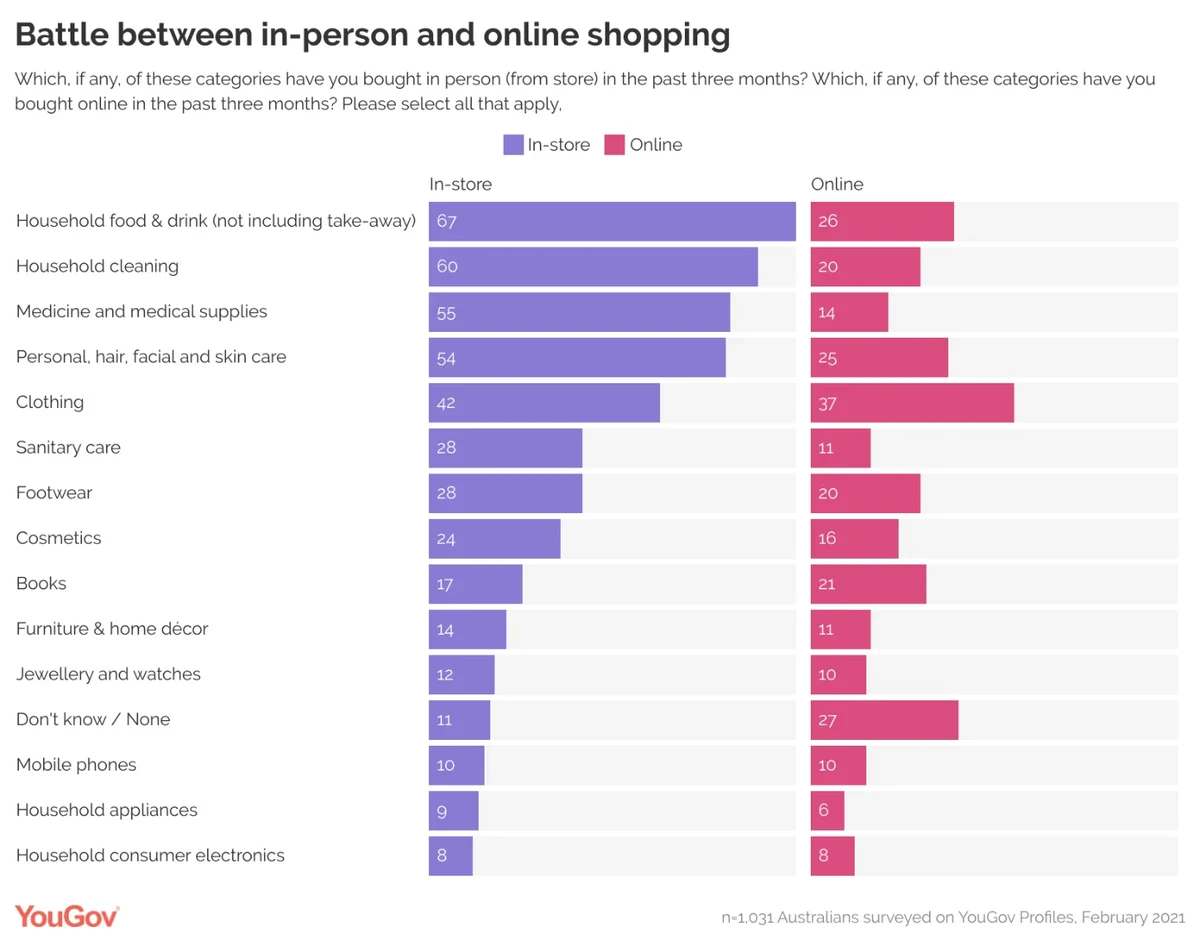

Four in five (89%) Australians have purchased something from a brick & mortar store in the past three months. Brick-and-mortar appears to be the go-to method for purchasing everyday essential items, such as household food & drink (67%), household cleaning supplies (60%), medicine (55%) and personal care (54%). Clothing (42%) is the only discretionary item in the top five most purchased things in-store.

Online shopping lags behind in-store shopping, with seven in ten (73%) buying something online in the past three months. Those aged 18 to 34 are the most likely to have shopped online, with eight in ten (82%) having done so. Conversely, online retail channels are the preferred channel for discretionary items such as clothing (37%), books (21%) and footwear (20%). Everyday items unsurprisingly are the most purchased items in both categories, however only a quarter (26%) of Australians bought groceries online in the past 90 days, compared to the two-thirds (67%) who stocked up in-store. Very few consumers shop exclusively at one channel or retailer – three quarters (74%) shop both online and in-store, 22% shop entirely in-store and 4% shop entirely online.

Despite the growth of online retail, there are still many shoppers that want to buy through brick-and-mortar outlets. YouGov asked Australian consumers about channel preferences for one specific and exceptionally large category—clothing. We then compared their actual shopping behaviour for clothing with what they wanted to do, to see how actions compared to desires. When asked which category shoppers would most prefer to buy in person, clothing came in second (55%), followed by footwear (54%) and furniture and home décor (43%). However, when compared to the data that shows only two in five (42%) have bought clothing from a brick & mortar store in the past three months, this suggests an optimism for brick & mortar stores looking forward – that after the pandemic ends consumers will return to the shopping channel they prefer.

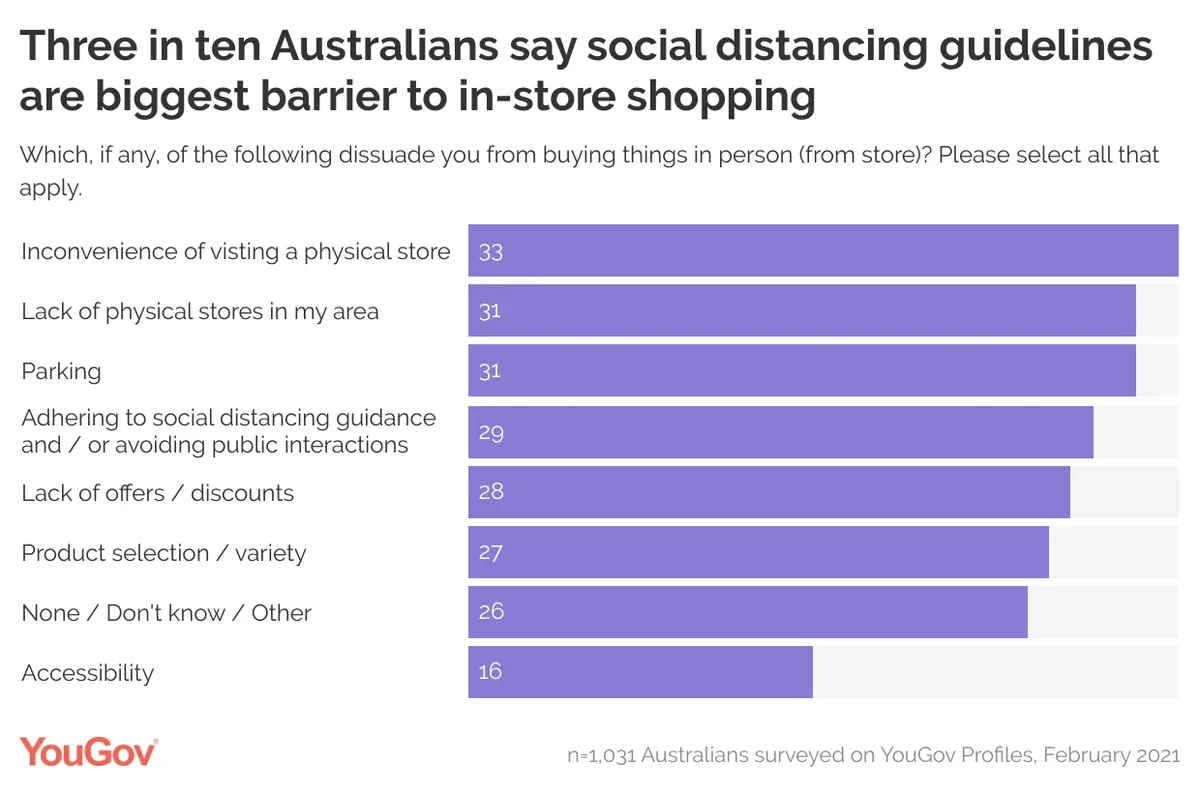

This belief that shoppers will return to in-person shopping could be supported by looking at the barriers Australian consumers say are keeping them from shopping in-store. Three in ten (29%) selected ‘adhering to social distancing guidance and / or avoiding public interactions’ as a reason for being dissuaded from buying things in-store. The main barriers according to consumers however are the inconvenience of visiting a physical store (33%), a lack of physical stores in their vicinity (31%), parking (31%) and lack of offers / discounts (28%).

The top motivations for people to visit a brick & mortar store are in-line with data showing higher preference to buy clothing in-person versus online, which are being able to physically experience a product (65%) and the ability try things in store (60%). Other motivations are speed of purchase (52%) and finding it easier (46%). Over a third (36%) also say they trust physical stores more than online stores and for those over 45, this jumps to over two in five (44%).

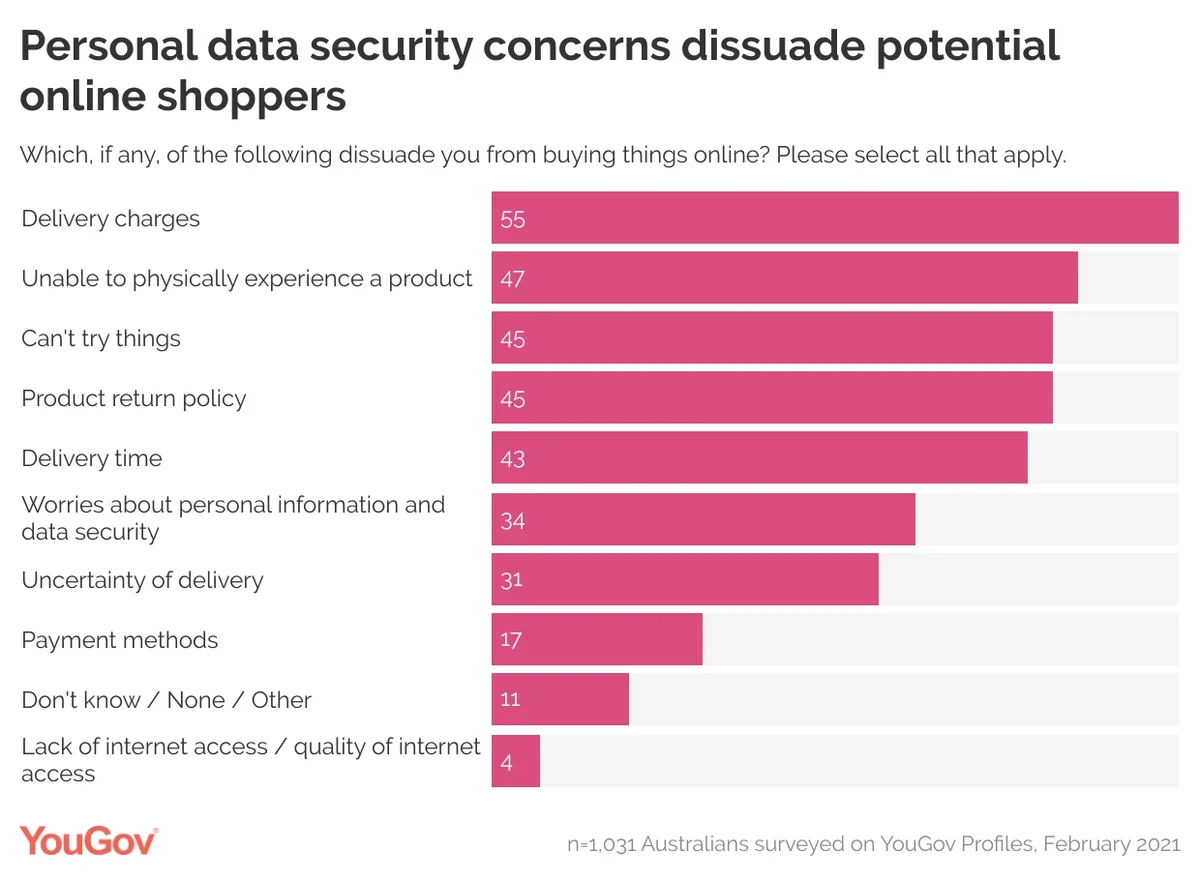

This lack of trust for online retailers is also reflected in the barriers identified by Australians when shopping online. A third (34%) have concerns about personal information and data security. Other reasons why one might not be keen to purchase from an online retailer is the delivery charges (55%), the inability to physically experience the product (47%) and product return policy (45%).

There are however, plenty of incentives to shop online, such as home delivery (48%), variety of products available (36%) and promotional offers (34%). Two in five (41%) also say it is easier to purchase things online overall.

***Results based on 1,031 Australians surveyed on YouGov Profiles